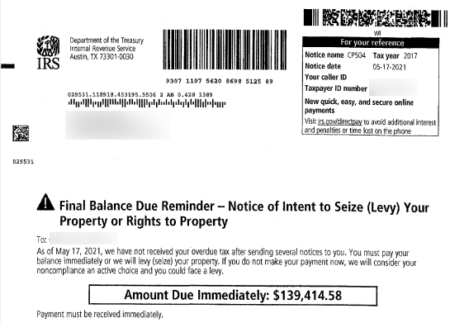

Has This Shown Up in Your Mailbox?

You are Not Alone

Does This Sound Like You?

- Years of unpaid back taxes

- Wage garnishment, liens, levies, or IRS seizures

- Threatening notices from the IRS

Then, You Need a Tax Attorney Who Specializes in IRS Tax Resolution

We’re Your Dedicated Tax Team.

15+ Years of Expertise

We have optimized our system of dealing with the IRS for over 15 years and aggregated all the nuances, insights, and best practices that will accelerate your resolution process and deliver results.

Millions in Saved Taxes

Thousands of clients have saved millions of dollars by making just one choice - they worked with our team of experts.

Reach Across 50 States

Our team brings expertise and credentials for 50 states covering all the jurisdictions across the United States. No matter where you are, you will not be alone.

Tested Approach. Dedicated Team of Experts

Bad things can happen to good people. And that is why we work around the clock to ensure you do not have to carry the burden of your back taxes and walk into bankruptcy, divorce, or severe financial distress.

Your problems are our only target. And we have a team of specialists trained and experienced in hitting their target – every single time.

The Financial Freedom You Deserve Is

3 Steps Away. Start Today

Discovery and Evaluation

Strategy Development

Execution and Resolution

Let’s Make Peace of Mind the Only

Thing Permanent About Your IRS Taxes.

IRS’ aggressive collection methods can rob you of your peace of mind. Our tax defenders are ready to help you get the control back into your hands.

All Your Questions – Answered

Post our discovery meeting and documentation process, most cases are resolved within 3 to 4 months. However, we do not take a boilerplate approach and focus on each case with the diligence it needs. In extreme cases, it can take up to 9 months to reach a resolution.

We will need your tax records and financial statements to calculate the Reasonable Collection Potential.

We can recover your W2, 1099s, 1098s, and other documents. You don’t have to worry about any of it, with our team by your side.

Prices will vary considerably depending on the scope of work needed to be done and the complexity of your general liability issue. We have been in business for over seventeen years, and find that it benefits the consumer to pay a fair fee for a fair service. There are simply no cutting corners.

In many cases we offer interest-free financing of our fee, allowing you to make payments over time. A general range for our services is as follows: simple tax returns can cost a few hundred dollars each, simple tax resolution cases can be between fifteen hundred and twenty five hundred each, and more complex cases can cost in the thousands.

As fees vary based on work, such as returns needing to be filed and garnishments needing to be lifted, please contact one of our tax associates for a free evaluation of your options and to better price your tax issues.

Yes! Tax Relief Pros brings comprehensive expertise in helping businesses and individuals to come out unscathed out of an IRS Audit. We would strongly recommend you book an appointment for a free consultation and get your process started.

Licensed to Solve Your Tax Problems.

Got a Tax Emergency?

Call Our Hotline.

Call our experts and get a free consultation for any of the following – Audit Defense, Bank Levy Removal, Wage Garnishment, Preparing Non-Filed Tax Returns, Eradicating Tax Liens, Penalties, and Interest, and Tax Resolution Negotiations